Even During a Pandemic, Demographics is Destiny

Despite widespread assumptions to the contrary, the pandemic did not start an urban exodus. That net outflow has been happening for a long time, but the pandemic accelerated the trends. In most cases, people have been moving fairly short distances – from cities to nearby suburbs – and a high a percentage of the moves have been temporary, often to existing vacation residences or temporary rentals in the exurbs of the large urban areas. And as a high degree of city dwellers are vaccinated, this transient exodus is already reversing.

The trend of people moving from cities to suburbs dates to immediately after World War II. Americans were looking for space and affordability; both had become difficult to find in city centers, along with job growth and lower taxes. From about 2000 to 2006 or 2007, however, the net outflow slowed. This was not a “rebirth of the cities.” It was merely the slowdown of the longtime trend as the attractiveness of cities increased amid falling crime and increased appreciation for the sorts of amenities in which cities excel.

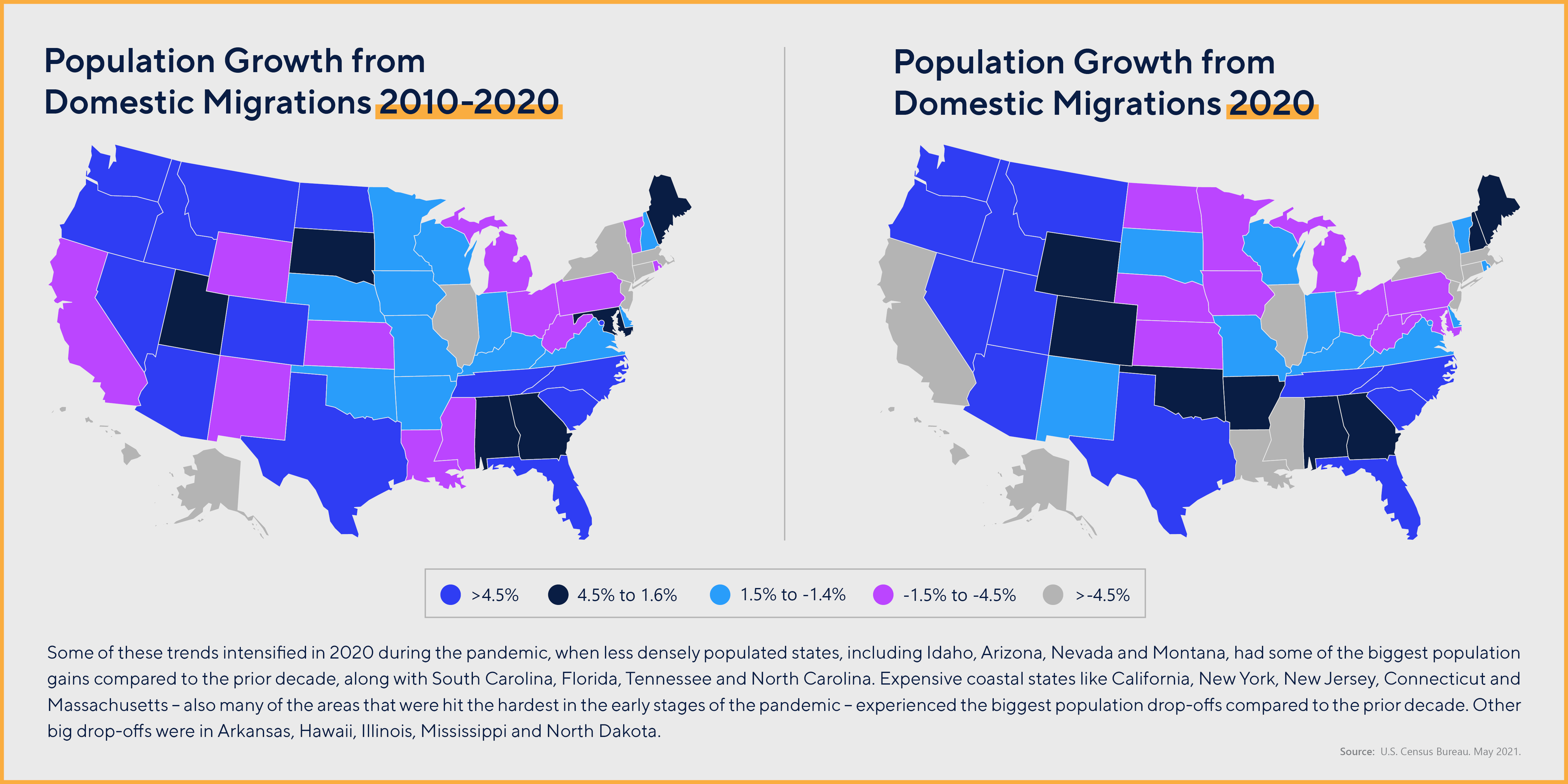

Within the past decade, the pattern reverted to the postwar norm: Americans chasing jobs, space and affordability. People began moving out of the Northeast, the Midwest and coastal California regions toward the Southeast, Southwest and interior Mountain West where homes tend to be cheaper and more spacious. During the pandemic, many people left their cramped apartments for larger suburban or exurban homes, but data show that most of them stayed within the same state. The trend is reversing for many transient movers. Financial hubs, particularly New York, are regaining residents, per U.S. postal service moving data, as companies’ mandated return-to-office dates near, while tech hubs continue to stagnate. From May to June 2021, Manhattan mailing addresses increased by 0.31 percent, while the San Francisco Bay Area’s population change was near zero. The disparity is reflective of tech companies more accommodating view of work-from-home capabilities and more distant return-to-office dates. The number of people moving long distances (more than 500 miles) and short distances (less than 50 miles) has decreased while the number of people moving “nearish” distances (50 to 199 miles) has increased. Not surprisingly, wealthier people who could afford to relocate to a vacation home or an Airbnb were more likely to move than those without the means to decamp.

The number of people moving long distances (more than 500 miles) and short distances (less than 50 miles) has decreased while the number of people moving “nearish” distances (50 to 199 miles) has increased. Not surprisingly, wealthier people who could afford to relocate to a vacation home or an Airbnb were more likely to move than those without the means to decamp.

What Drives Urban Growth in Normal Times? Immigration and Fertility

The births per woman in the U.S. fell to an all-time low of 1.6 in 2020, less than half the levels during the baby boom. Immigration helped make up for the fertility declines in recent decades, but it has cooled in recent years, especially since the previous administration cracked down on immigration.

The combination of reduced immigration and reduced fertility has led to a stark slowdown in overall U.S. population growth: The 0.35 percent growth in 2020 was the lowest since the 1930s during the Great Depression. From 2019 to 2020, urban counties’ population fell 0.3 percent, in large part from declining immigration. These trends have been exacerbated by the excess deaths caused by the pandemic, which surpassed 600,000 by June 2021 in the U.S.

More Young Adults Are Staying Put

By the summer of 2020, the percentage of 18- to 29-year-olds living at home reached 52 percent – higher than at any time in the 20th or 21st century. The proportion of young adults living with their parents was already very high in the aftermath of the Great Financial Crisis (GFC) and the increasing burden of student loan debt. During the pandemic, this figure swelled further, as many 20-somethings left their city apartments and moved back in with their parents in the suburbs as bars, restaurants, cultural venues, and workplaces closed and remote work enabled them to be further distances from their jobs. Whether or not companies mandate a return to the office, many young professionals want to return to an urban lifestyle, spurring population inflows back to cities.

Death of the Cities? Not So Fast

Many assume that the pandemic will bring on a retail apocalypse, at least in major metros like New York, San Francisco and Chicago, and many gyms, restaurants and stores have closed permanently. Eventually, businesses and people will adjust. Rents will fall, people will become more flexible in how they use their space and landlords will change their lease terms. This will lead to a recalibration to something like what was in place before the pandemic.

We are already seeing signs that the cities are coming back to life. It is important for investors and individuals to understand this before making long-term decisions based on short-term behaviors, even if we see a resurgence of the virus.

To learn more about SitusAMC’s research and data offerings, click here.