Living in the Snow Globe: How Will New Trump Policies Shake Out?

The Trump administration has taken a radically different approach to policy than the previous administration, resulting in a current state of great political and economic uncertainty.

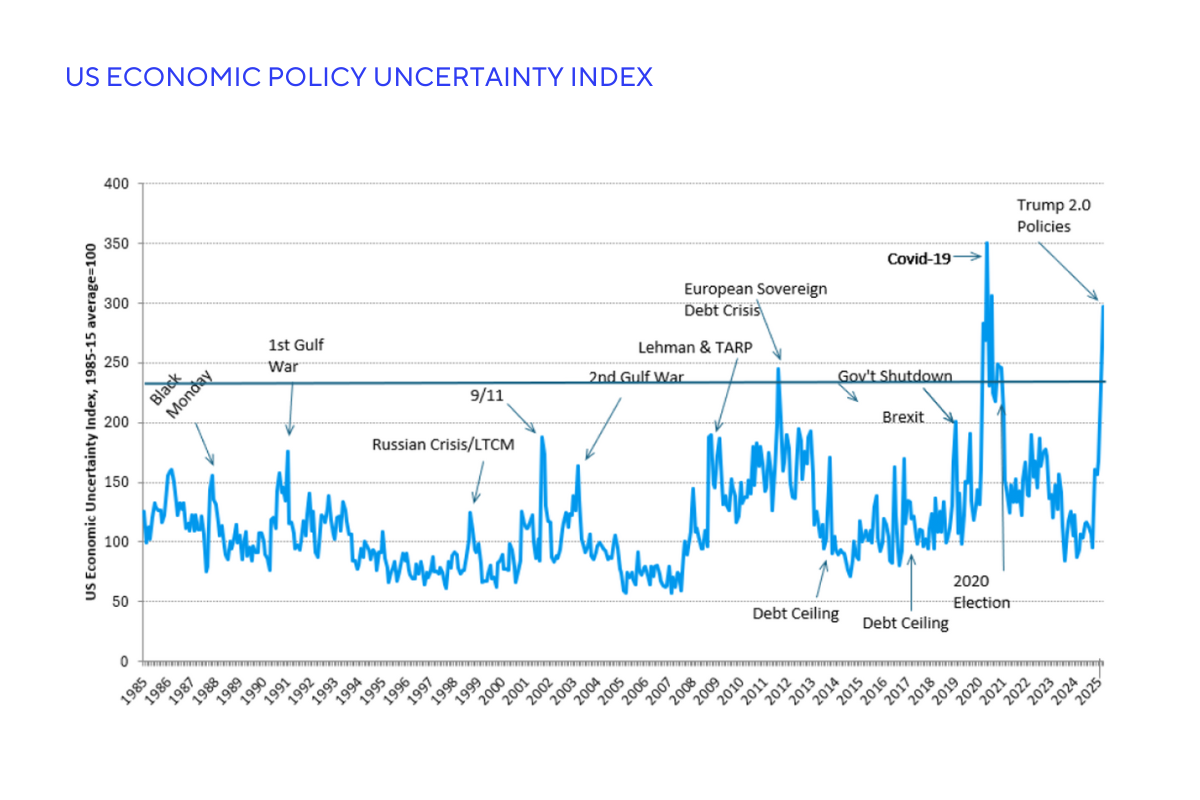

The new, rapid fire, and changeable Trump administration policies have led to great economic uncertainty as measured by the Index on US Economic Policy Uncertainty (see chart below) – the second-highest level on record, just behind COVID-19 and well above the levels seen during the GFC. In March, the index had increased 89% from the beginning of the year representing the anxiety created by the combination of news coverage of policy-related economic uncertainty, tax code uncertainty and economic forecaster disagreement. This reading was prior to the early April imposition of extended tariffs and the subsequent equity market meltdown, which will likely only increase the index further.

Trump Administration Policies Have Led to Near Record Economic Uncertainty

Sources: Measuring Economic Policy Uncertainty' by Scott Baker, Nicholas Bloom and Steven J. Davis at www.PolicyUncertainty.com, SitusAMC Insights.

There are many unknowns – including whether the tariffs will remain in place long term or whether they are being used by the Trump administration as a negotiation tactic. On the immigration front, labor market effects are not yet clear as the extent of the policy is uncertain. However, most economists agree that the risk of recession or stagflation has increased. Tariffs, uncertainty surrounding the tariffs, the market reactions to both, labor market effects of immigration changes, the sharp cutbacks in the federal workforce, spending, and return-to-office mandates for federal workers all can have significant, and even opposing, effects on economic growth and inflation. This briefing provides a look at the potential impact of tariffs on the economy, capital markets and commercial real estate (CRE) industry.

Skip to a Section

Tariffs

Immigration

Department of Government Efficiency (DOGE)

Return-to-Office Mandates

TARIFFS

Fears of a recession or perhaps stagflation have grown as a result of President Trump’s imposition of tariffs in early April. This section takes a deep dive into the economic, capital markets and CRE implications.

President Trump announced a new tariff regime on April 2nd, imposing a 10% tariff on all U.S. imports starting April 5th. Higher rates for certain countries will begin on April 9th, with China facing a 34% tariff on top of the 10% tariff previously imposed. Following the imposition of the 34% tariff China announced a 34% retaliatory tariff, after which President Trump threatened an additional 50% tariff. If this were to happen, with all tariffs included, China would face a 104% tariff. The additional tariff for imports from Canada will be 25% for most products, with a 10% rate for "energy or energy resources." The additional tariff for imports from Mexico will be 25% on all imports, the same as Canada without the energy carveout. Meanwhile, the additional European Union tariff was placed at 20%, Japan 24% and the UK at 10%. The tariffs are calculated based loosely on the trade imbalance between the US and its trading partners. For instance, the original 34% tariff on China is derived from the US goods-trade deficit with China of $295 billion divided by the amount imported from China ($439 billion), then halved (67% divided by two), per calculations by the Wall Street Journal. These tariffs add to a range of duties that Trump had previously implemented early in his second term which targeted numerous products from Canada, Mexico, and China, along with steel and aluminum. Additionally, Trump confirmed a 25% tariff on foreign-made automobiles effective April 3rd. Taken together, President Trump's tariff policy enforces a weighted average tariff rate of 18.3% on trade partners of the US, per Goldman Sachs Research.

While the administration initially planned few exemptions, it later published a list of carve-outs covering about $644 billion worth of imports, including $185 billion from Canada and Mexico in return for political concessions such as increased border control efforts from these countries. Despite these exemptions, many products remain subject to industry-specific tariffs and new tariffs on sectors like pharmaceuticals and critical minerals are expected.

Responses from foreign nations have varied. China, the US’s third-largest trading partner, announced it would impose a 34% tariff on US goods starting April 7th. The European Union is also considering retaliatory tariffs. Conversely, President Trump stated on Friday that Vietnam has offered to reduce its tariffs on US goods to zero, in hopes of persuading the White House to lower the 46% tariff it has proposed for the country. Vietnam, which has an emerging manufacturing sector and is viewed as a country that China uses as an intermediary to circumvent already existing tariffs. However, it remains uncertain how the White House will respond to these foreign government offers. Meanwhile, the administration has threatened to increase the China tariffs further if China does not rescind its retaliatory response, portending the possibility of further tariff escalation.

MARKET REACTIONS

The markets reacted swiftly and severely after the announcement of the Trump reciprocal tariffs on April 2nd and China’s announcement of counter tariffs on April 4th. Stocks saw their largest losses since the onset of the pandemic, erasing $5 trillion in value in the two days following the announcement. During the week of April 4th, the Nasdaq fell 10% and entered into a bear market, down more than 20% from its most recent high. The S&P 500 sank 9% and closed in on bear territory, and the Dow was down 8%, entering into correction territory.

Concerns that the tariffs will hit economic growth hard initially led to a rally in the bond markets. The 10-year Treasury yield fell 20 bps in the two days following Trump’s announcement of the tariffs, spending much of April 4th around 3.9%, the lowest rate since October 2024. However, on April 7th, bond yields backed back up to nearly 4.2%, as investors began to back off the US as a safe haven and stagflation fears mounted.

ECONOMIC IMPACT

There are both immediate term and longer term potential economic impacts from the new Trump policies. In the immediate term, the sharp jump in household and business uncertainty and the loss of confidence alone has the potential to weaken the economy. Both consumers and businesses generally respond to bouts of extreme uncertainty by holding back spending and investment. The sharp drop in equities would reinforce this, exacting a significant wealth and psychological impact on willingness to spend.

Inflationary Pressures & Credit Spreads

Most economists consider the more lasting impacts of tariffs to be inflationary, with the bulk of costs passed on to consumers unless tariff burdens can be significantly absorbed in corporate margins (resellers and exporters) or exchange rate differentials. Although spending might temporarily rise due to pre-emptive buying, the high prices would significantly curtail consumer spending eventually, potentially tipping the US into a recession and across-the-board price decreases.

However, tariffs are also likely to stunt economic growth and raise unemployment, as business supply chains are disrupted and consumers cut spending in the face of higher prices, strengthening the prognosis of stagflation. The likelihood of stagflation has also increased because of the workforce implications of the administration’s tough stance on illegal immigration, as labor market supply falls and wage pressures expand. The DOGE-related austerity measures could also contribute to weaker growth as unemployment rises; this impact could be more intense in regional pockets with high levels of federal employment.

A reduction in immigration is unique in that it can result in both a labor shortage and inflation. According to The Center for Migration Studies of New York (CMS), about 5% of the total U.S. workforce is undocumented, working in industries such as agriculture, construction, service and hospitality. Without their participation, there could be significant disruption to the U.S. labor market, as a sharp decline in the workforce could induce shortages in key industries, higher wage costs and increased inflationary pressures, putting renewed upward pressure on interest rates.

For CRE, rising interest rates in response to inflation would likely lead to a decline in capital availability, with lenders tightening underwriting standards. This would make it difficult for developers, investors and owners to secure loans or refinancing, a precarious situation which would likely lead to a rising number of distressed assets, given the wall of CRE maturities expected in 2025. If rising interest rates also drove cap rates up, that would undermine CRE valuations.

Reduced access to capital would temper already muted deal activity and slow the pace of originations and servicing. However, rising interest rates and troubled loans mean increased business for special servicers.

Rate Cut Dilemma

There is a chance that the Fed could stave off a recession by lowering short-term rates. One day after President Trump announced the reciprocal tariffs, money markets priced in a 50% chance of the Fed delivering four quarter-point rate reductions this year due to the anticipated economic hit, according to Bloomberg. While Wall Street analysts are now anticipating as many as five rate cuts this year, Fed Chairman Powell said that he expects the tariffs to raise inflation and lower growth, and that the Fed faces a “highly uncertain outlook” because of the new reciprocal levies the president announced on April 2nd, keeping the Fed on hold for now on the interest rate moves.

Should the Fed rate cuts result in a decline in long-term interest rates, and the US avoid a recession, there could be some much-needed relief in CRE lending, boosting new mortgage originations and refinance activity, and propping up CRE valuations and returns.

However, conversely, Fed rate cuts may also be viewed as ignoring inflation risks. If this narrative were to take hold, the front-end of the curve could move down; however, the back end of the curve (10 year and beyond) may stay at the same level or even go higher. Any steepening of the yield curve would offset the impact of lower front end rates and may further impair CRE lending, valuations, and returns.

Capital Flows

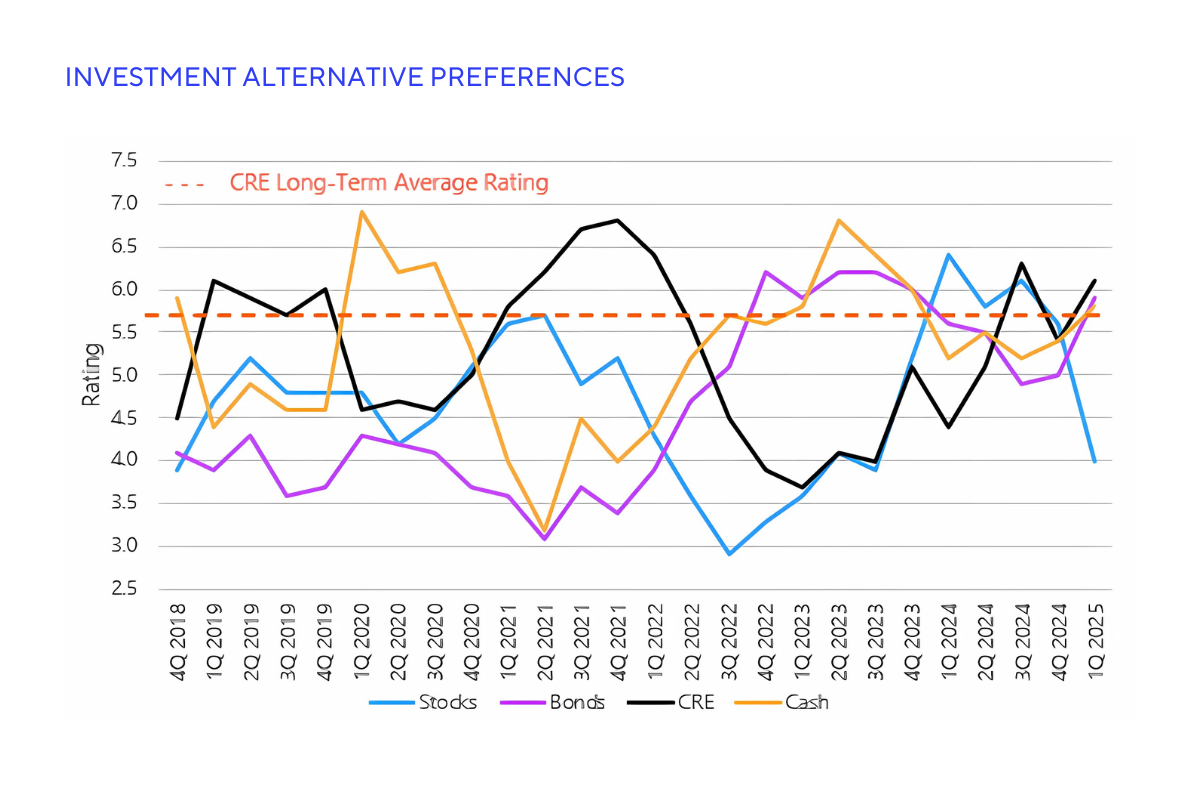

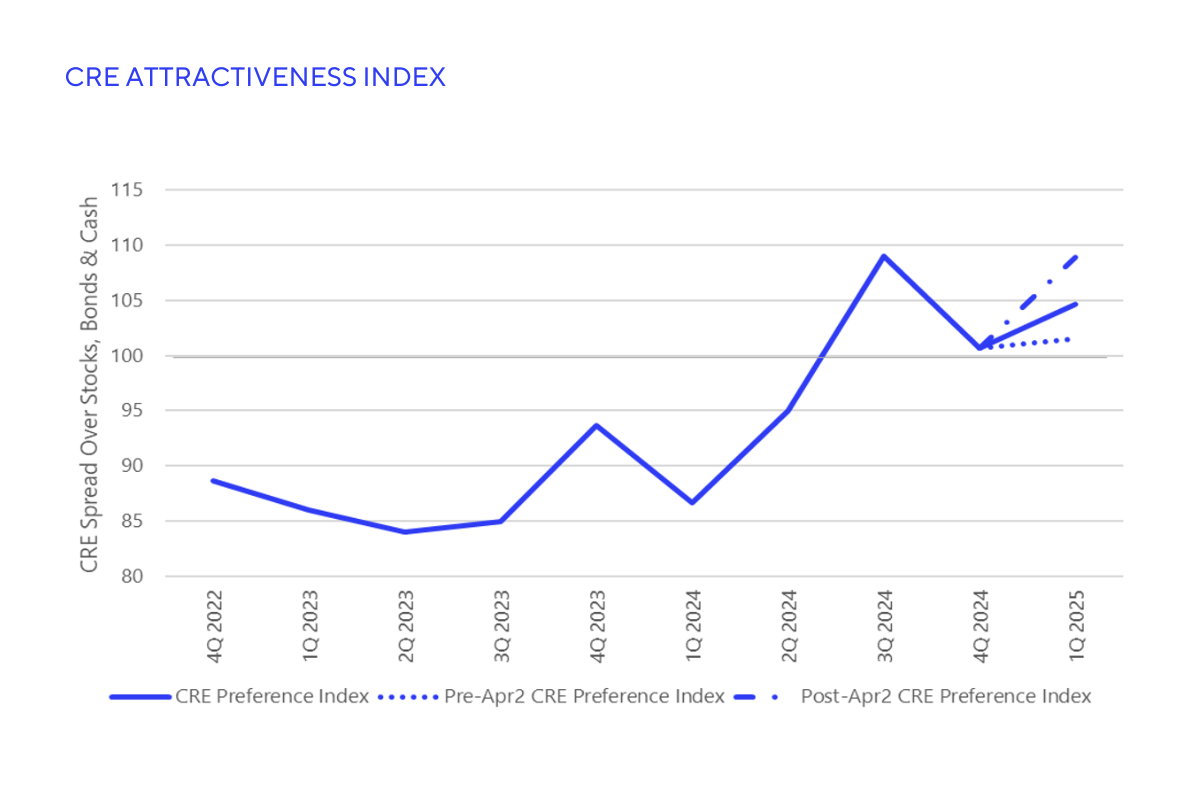

CRE has been in a capital markets downturn since mid-2022. Investors shifted from highly favoring CRE to viewing it far less favorably than other asset classes (see chart). Last year, as the prospect of lower interest rates emerged, investor attitudes toward CRE began to improve, though disappointment late in the year on interest rate movements led to some backsliding. New data covering the first quarter from SitusAMC Insights shows that the volatility through March heightened investor interest in CRE as a relative safe haven (see chart). Indeed, micro data from our survey showed a decided positive shift in responses on attractiveness of CRE relative to other classes, due primarily to a sharp downward shift in favorability toward equities, following the April 2nd Trump announcement. Improved capital flows to real estate would have positive impacts on investment, lending and deal flow.

Optimism for CRE Ticks Up Amid Political and Economic Uncertainty, Especially Following Tariff Announcements

The RERC Attractiveness Index shows CRE investors’ changing preferences for CRE over the traditional asset classes. The baseline of 100 indicates that investors feel traditional assets and cash, on average, are as attractive as CRE. Sources: RERC, SitusAMC Insights.

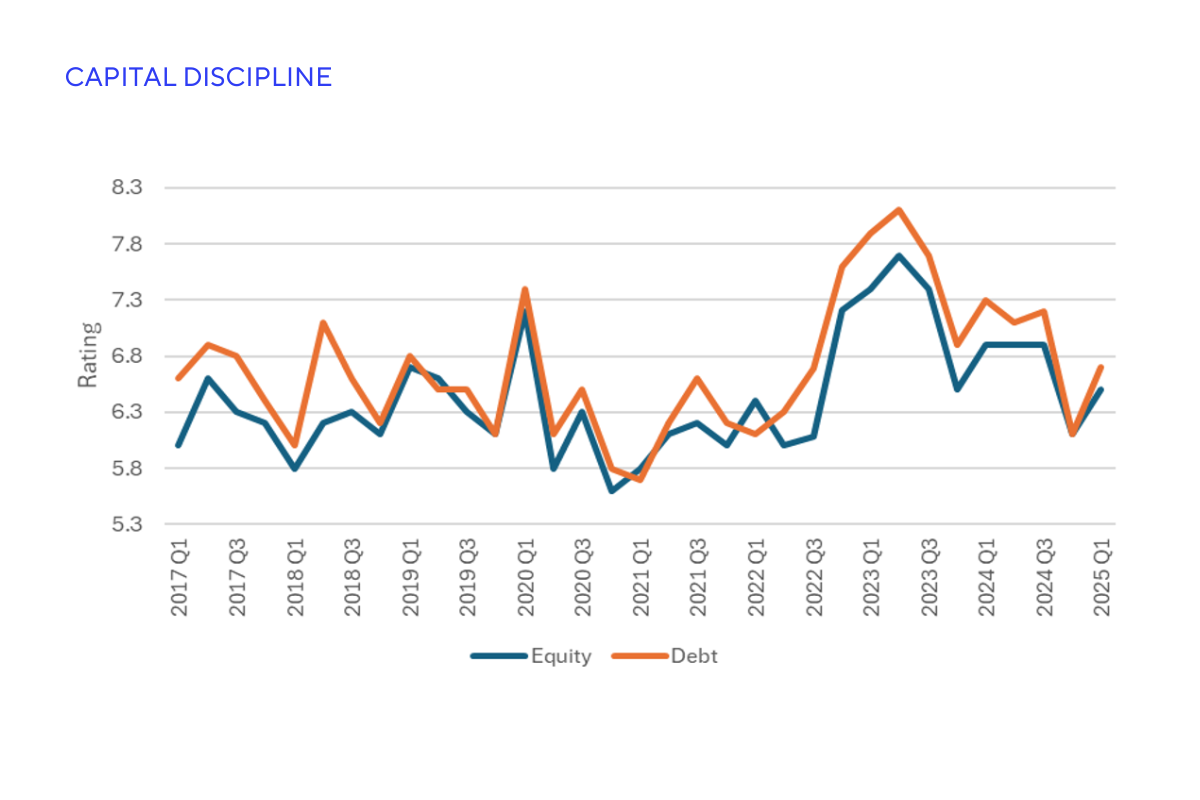

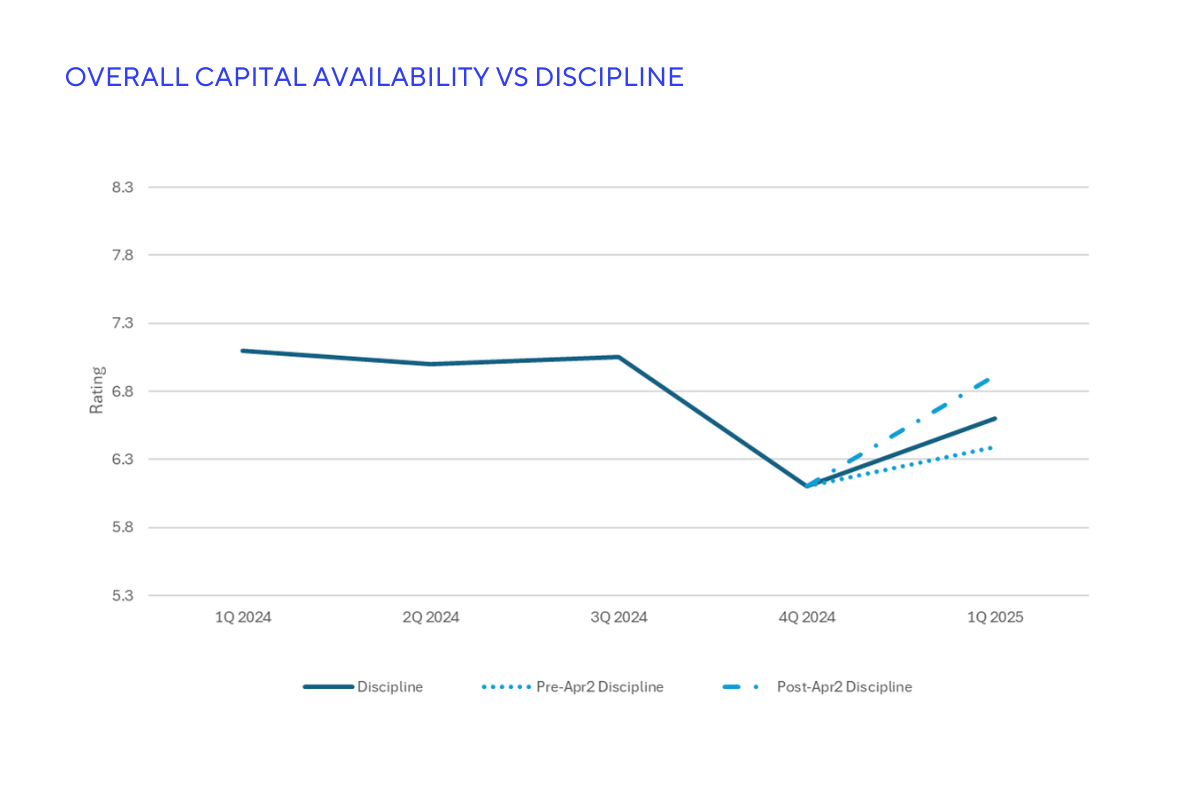

We anticipate capital to become more disciplined as a result of these policies, market turmoil and heightened uncertainty, and the results of our first-quarter survey confirm this (see charts). Equity and debt capital discipline increased in the first quarter from the fourth, with investors indicating overall discipline increased discipline following the Trump announcement on April 2nd. However, we will likely not see a complete drying up of capital in the alternative lending space. Following COVID-19, we saw a rise in alternative lenders as traditional, highly regulated, banks adopted extremely conservative lending practices. In the CMBS space, while the economic uncertainty may cause some of the smaller B-piece buyers to retreat, the larger investors, which have the requisite specialized product knowledge and risk appetite, will keep capital dedicated to CMBS, even when the market is down.

Equity and Debt Underwriting Standards Increase Amid Uncertainty

Following Announcement of Tariffs, Underwriting Standards Tighten

Availability ratings are based on scale of 1 to 10, with 10 being plentiful. Discipline ratings are based on a scale of 1 to 10, with 10 being extremely restrictive. Sources: RERC, SitusAMC Insights.

However, a budding concern is that the US will lose its safe-haven investment status as a result of tariffs and other Trump administration policies. Given the political polarization, it is very difficult for investors to predict how long policies will remain in effect, given that each new administration tries to undo many of the policies set by the prior administration. In addition, there is growing concern that the US will lose political allies as the White House attempts to guide the US away from globalization toward protectionism, weakening its status on the international stage. The backing up of bond yields on April 7th, following their initial slide the previous week, was attributed by some analysts to the impact of the US safe haven affect diminishing.

CRE IMPACT: DISPARATE EFFECTS

Even under more certain circumstances, public policies would have complex effects on real estate markets, with the potential to be both good and bad for different stakeholders (e.g., investors, lenders, owners, consumers) and for different property types. For example, the rising cost of building materials as a result of tariffs or immigration could harm multifamily developers and opportunistic investors, while at the same time benefitting existing owners of multifamily properties because the decreased new supply would limit competitive space and increase replacement value. In addition, rising inflation could also translate into decreased consumer spending, hurting retail and industrial real estate as well as the ability of multifamily landlords to raise rents. On the other hand, widespread inflation may lead investors to increase allocation to CRE assets, given the sector’s ability to serve as an inflation hedge. Rising interest rates would likely lead to a decline in capital availability, with lenders tightening underwriting standards, to the detriment of developers’, investors’, and owners’ abilities to secure loans or refinancing and cause the pace of originations and servicing to slow. However, rising interest rates and troubled loans mean increased business for special servicers. Should DOGE succeed in its efficiency initiatives, the federal deficit could significantly decline, putting downward pressure on interest rates to the benefit of CRE performance and lending activity, but potentially harming multifamily owners and operators if lower interest rates result in a shift toward homebuying.

SitusAMC is uniquely positioned, supporting the lifecycle of CRE lending and investing and, therefore, we have insights into the current state of the market, lender and investor sentiment, and the potential impacts of the tariffs, other Trump policies, and subsequent market volatility.

Originations & Advisory

Experts on SitusAMC's Strategic Advisory Solutions team, which provides underwriting, transaction and advisory support, are observing that the current market is characterized by muted deal flow, with a notable increase in competition for high-quality deals. At the front end of the origination process, there remains a significantly high volume of loan sizing activity that has continued to trend upward. The high volume can be seen as a positive as there is a need to size numerous deals to find a few worth bidding on, essentially “a numbers game.” These experts are seeing heightened scrutiny during the underwriting and credit approval processes, which sometimes create closing delays. If a loan is slated for a securitization exit, previewing the deal with the b-buyer and rating agency prior to closing in order to mitigate risk of the loan not being accepted into the securitization is the “new norm.” Traditional balance sheet lending has become more constrained, which could potentially point to more opportunities for alternative lenders, especially in the mezzanine space.

The current uncertain and turbulent environment highlights the interconnected nature of the economy and capital markets. For example, reduced consumer spending from rising inflation could hurt local businesses, which in turn would affect retail owners and lenders. If tenant income is constrained and unable to pay rent, landlords would be less likely to make property improvements with the aim of pushing up rents and more likely to hold onto their property, ultimately muting refinancing activity.

Deal activity was at a good pace at the end of last year as borrowers began to acclimate to the higher interest rate environment. Now, investors are having to contend with massive economic and business uncertainty. As an investor with capital to deploy, it is difficult to ascertain which investment will succeed in the current market and provide a good return. It will be worth watching for any moves by major lenders to trim activity, as market participants often respond in kind to evidence of a drawback.

Securitizations

SitusAMC’s Securitization support team notes that one of the biggest achievements in the originations and securitizations industry over the past year has been the substantial pickup in the CLO market. There has been an increase in transitional assets, such as build-to-rent, rehabs and conversions. There has also been appetite for riskier assets and transitional bridge loans. The last few deals that have gone to market have priced wider than expected, potentially indicating that investors are becoming pickier with deal structures.

However, SitusAMC is already starting to see some cracks in the market with property values from appraisals coming in lower than expected, and CMBS deals getting smaller and tougher to originate. Should we see increased inflation, the rising costs of building and renovating materials would make some developers’ business plans less viable, muting securitization activity. However, if interest rates continue to drop, we would likely see a jump in originations and refinancing. We may also see a rise in prepayments as investors seize the opportunity to get out of defeasance early and reduce their debt load or look to capitalize on lower interest rates.

Special Servicing

As the possibility of recession increases from economic uncertainty, SitusAMC’s Special Servicing team states that there will likely be an increase in special servicing activity. If consumers pull back and space market conditions deteriorate as a result, we could see a significant upturn in loan mitigation and workouts. Currently, special servicing activity is primarily reflective of term defaults; this could be supplanted by payment defaults. SitusAMC notes that reduced consumer spending and elevated inflation could lead to significant challenges in the hospitality and multifamily sectors, in particular, resulting in more payment defaults. While maturity defaults are currently more prevalent due to higher interest rates and refinancing issues, there would likely be a shift toward payment defaults if the economy sours.

Debt Valuations

SitusAMC's Debt Valuation team recognizes the difficulty that investors face in trying to navigate the capital markets, whose recent volatility and uncertainty has led to values of fixed-rate assets fluctuating dramatically. Certain indicators like the 10-Year Treasury yield have shown downward momentum in a positive sign for debt valuation (though if the recent reversal of yields holds this is no longer true), while the equity markets, including major financial institutions like Bank of America, have experienced significant recent declines. Inflation has dropped dramatically from recent 2022 peaks and has appeared to bottom out over the last year yet has remained well above the Fed’s target of 2%, with experts worried about the potential inflationary effects of Trump’s tariffs. These mixed signals have created a challenging, volatile environment for debt valuation. The valuations team also expressed concern about how the recent stock market plummet, plus any added economic turbulence, could lead to higher defaults and more volatility in the lending markets. This could cause absolute spreads and yields to widen.

Equity Valuations

SitusAMC's Real Estate Valuation Services (REVS) serves private CRE investors, such as pension funds, endowments and life insurance companies, which have a long-term focus. These investors value the security, stability and growth potential of CRE investment over the long haul, potentially diluting some of the negative impact of tariff-related volatility in the near term. Allocations to private commercial real estate, whose values have dropped notably since 2023, could be poised to benefit from any correction in equity markets, which have increased significantly since 2023 before plummeting in April amid the announcement of tariffs. Our data on investor preference for private commercial real estate pre- and post-April 2nd announcements indicates an initial decided shift in favor of CRE. The long-term impact of tariffs on valuations is dependent upon investor expectations around Treasury yields and the cost of capital, with CRE potentially standing to benefit from any further clarity on policy that could contribute to Treasury yields decreasing.

SitusAMC notes that CRE has effectively been in a capital markets recession for 2 1/2 years, driven by the rising cost of debt. During this time, the 10-year Treasury rate has been volatile but spiked near 5%, greatly increasing the cost of capital. Cap rates generally went up about 100 bps and CRE values across the NCREIF-ODCE universe are down roughly 20%.

A 25 bps change in cap rates (up or down) offsets about a 5% change in NOI growth. This is why the level to which Treasury rates (and cap rates) reset is crucial for CRE valuations. Through the volatility in Treasury rates in since mid-2024, CRE investor expectations have remained relatively steady. Were rate expectations to reset once the dust is settled to say 3.5%, it could strengthen valuations even amid slowing NOI growth from a weaker economy. Given these dynamics, SitusAMC expects values to be relatively stable over the next quarter and throughout the year.

IMMIGRATION

Immigration has two connected but disparate effects: labor shortage and inflation. Real estate markets would generally suffer from slowing development projects and increased operational costs, but landlords may find some reprieve from limited new supply.

The first two weeks of Trump’s second presidency saw several executive orders and laws targeting illegal immigration. These included measures aimed at both stemming border crossings and mass detainment or deportation of undocumented immigrants. These policies will likely produce winners and losers in the real estate market, due to their effects on labor costs and availability, construction, inflation and interest rates.

Estimates of the number of undocumented immigrants living in the U.S. vary, but the Department of Homeland Security, the Migration Policy Institute and Center for Immigration Studies, peg the number between 11 and 12 million. According to The Center for Migration Studies of New York (CMS), about 5% of the total U.S. workforce is undocumented, working in industries such as agriculture, construction, service and hospitality. Without their participation, there could be significant disruption to the U.S. labor market, as a sharp decline in the workforce could induce shortages in key industries, higher wage costs and increased inflationary pressures, putting renewed upward pressure on interest rates.

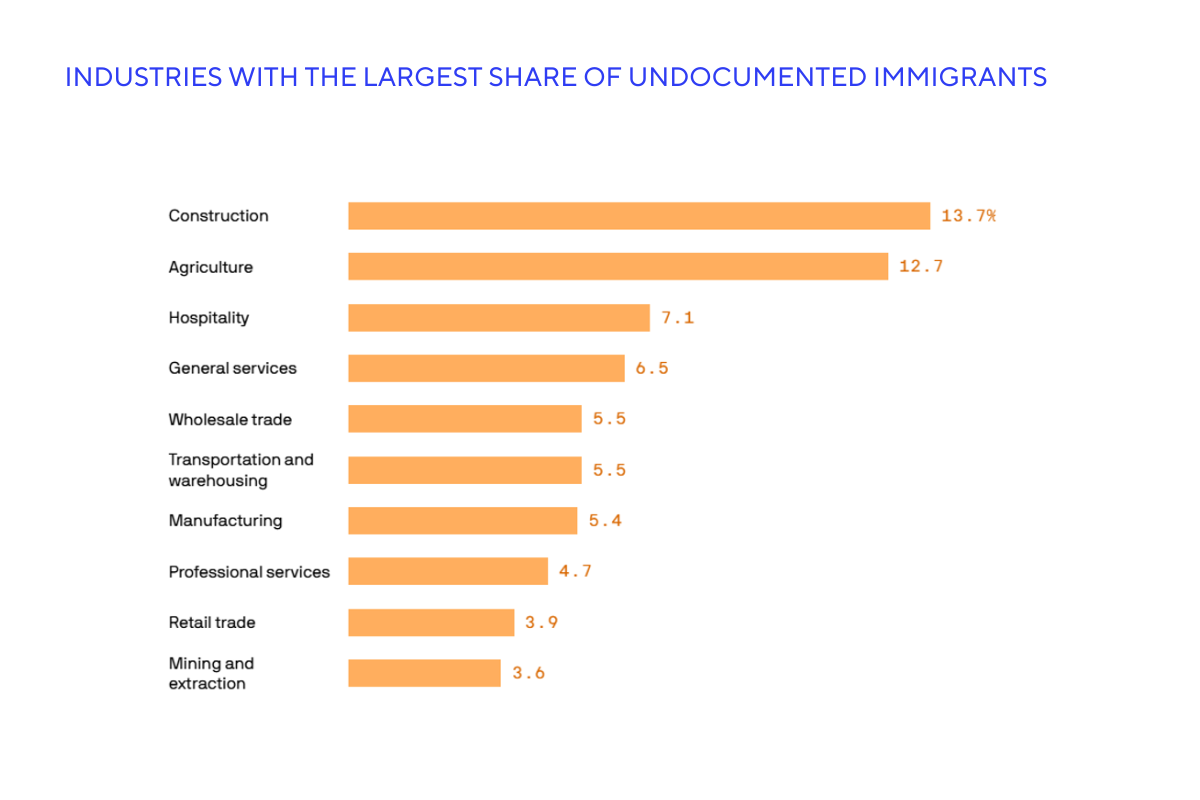

Construction, agriculture, and hospitality are most likely to be hit by mass deportations, as these industries have the largest share of undocumented immigrants. (See chart.)

Sources: American Immigration Council, Axios, SitusAMC.

In addition, undocumented immigrants paid $96.7 billion in federal, state and local taxes in 2022, according to the most recent data available from the Institute of Taxation and Economic Policy. At the state and local levels, 46%, or $15.1 billion of the tax payments made by undocumented immigrants are through sales and excise taxes levied on purchases. Most other payments are made through property taxes, such as those levied on homeowners and renters (31%, or $10.4 billion); or through personal and business income taxes (21%, or $7.0 billion). Should mass deportations occur, economic growth could be diminished and the federal deficit could grow, leading to an upswing in interest rates.

This anti-immigrant stance could have longer-term impacts as well. High-profile detentions of foreign graduate students coupled with cuts to federal grants to universities could deter educational and professional pursuits by foreigners, risking a potential “brain drain” as top minds seek opportunities outside the US. This stance could also impact tourism if foreigners broadly no longer feel welcome to the US or feel inclined to boycott policies. Evidence of a significant drop in tourism to the us FROM Canada has been noted in the press and several airlines have reduced their US/Canada flight capacity. The tourism industry is already sensitive to economic cycles, so the hospitality industry and certain markets that rely more on tourism could see greater economic consequences.

The effect of immigration policies on real estate also hinges upon the extent to which they contribute to accelerating inflation and a rise in interest rates. Existing owners and equity investors would be hurt by rising interest rates, as they will likely lead to a contraction in capital availability, expanding cap rates and declining valuations. However, investors and owners may see some benefit from a limited new supply, driving vacancies lower and rents higher.

Developers and opportunistic investors will likely be hurt by rising construction labor costs, making projects difficult to pencil out. Similarly, existing property owners, and their lenders, face risks from rising operational costs, which would reduce net operating incomes and put downward pressure on property valuations. Retail, especially food and drink establishments, along with hospitality, would be particularly vulnerable to labor shortages and higher wages.

Rising interest rates would likely lead to a decline in capital availability, with lenders tightening underwriting standards. This would make it difficult for developers, investors and owners to secure loans or refinancing, a precarious situation which would likely lead to a rising number of distressed assets, given the wall of CRE maturities expected in 2025. Reduced access to capital would temper already muted deal activity and slow the pace of originations and servicing. However, rising interest rates and troubled loans mean increased business for special servicers.

DEPARTMENT OF GOVERNMENT EFFICIENCY (DOGE)

As the new administration focuses on improving government efficiency, this could contribute to a reduction in the federal deficit and a decline in interest rates. Should these austerity measures lead to a weakening of the economy and labor market, real estate fundamentals could soften.

Within the first few weeks of the new administration, Elon Musk’s Department of Government Efficiency (DOGE) made sweeping changes to federal government departments, in response to a campaign promise to cut $2 trillion in federal spending. The feasibility of these figures has been questioned, as the entire discretionary budget is less than $2 trillion. Musk already conceded that $1 trillion may be more realistic. Limited details also make it difficult to project the impacts, but the intent for cutbacks is clear as more information is released. DOGE has begun slashing federal jobs at a steep pace, which has yet to have a sizeable impact on US headline employment figures but is appearing in other data. According to Challenger Gray & Christmas, announced layoffs by US employers surged 60% in March to over 275,000 jobs, the highest level since May 2020. The federal government has accounted for nearly 80% of these jobs with 216,215 announced in March. Many of the recent moves are already being challenged in courts, with an expectation for more legal pushback ahead. While the Supreme Court is expected to align with the administration, these challenges could still delay or limit the scope of proposed cuts. This could be the case with many Trump initiatives or policies, but also applies to DOGE. With many unknowns at this point, the potential impacts of DOGE on real estate markets are likely mixed.

If DOGE succeeds in its efficiency initiatives, the federal deficit could significantly decline. A more favorable outlook for U.S. debt could bring downward pressure on interest rates, resulting in much-needed relief in CRE lending and returns. This could also lower mortgage rates for homebuyers, potentially opening up the housing market to more sales, boosting new mortgage originations and refinance activity. This could divert some expected rental demand in the coming years back toward buying, hurting multifamily owners and operators.

At the same time, however, if DOGE is unsuccessful in its efficiency initiatives, the reduction in employment and spending could hurt the broader economy and further raise recessionary fears. Perhaps private industries replace some of this economic activity, but the disruption and downside risks are wide- ranging. These cutbacks could also have geographic implications as D.C. and the surrounding areas, like northern Virginia and suburban Maryland, are highly connected to federal government activity. Population declines and reduced demand for housing would put pressure on home prices and rents, hurt retail spending and sap demand for industrial space. Such a scenario would hurt office demand as well, both directly from the government and from the resulting economic threats.

The office segment will likely be most transformed by DOGE initiatives. The Federal government owns 370 million square feet of office space nationwide. However, much of this stock has been poorly maintained due to lack of funding, and sits empty or underused. Elon Musk has stated that the federal government is spending roughly $15 billion per year on maintenance and utility costs at unused government buildings in the U.S. and abroad. President Trump has indicated that he wants to sell approximately two-thirds of the government’s office portfolio, adding more supply to the beleaguered sector. On March 4, the Trump administration released a list of 443 federally owned office buildings for sale, including the headquarters of the Labor Department, US Census Bureau and Justice Department. As of March 5, however, the list had been removed, making it unclear what the administration’s policy will be. While the initial list of for-sale properties was nationwide, the D.C. metro area would be the most affected, with one-third of the buildings in the District or the Maryland and Virginia suburbs. Other targeted cities include Chicago, Atlanta and Cleveland. In addition, about three-quarters of the 70 million square feet of office space the government leases from private landlords in D.C. will likely be canceled. In fact, by the first week of February, the government had terminated 22 leases at underutilized buildings, resulting in $44.6 million in savings. DOGE says GSA intends to terminate nearly 800 leases, estimating roughly $500 million in savings over the terms of the leases. While some have been walked back and confusion remains around others, dozens of lease cancellations are already expected by June 30 with many more expected throughout 2025. Such cuts could profoundly impact the district, where the government occupies one-third of office space, and ripple across housing, retail and lodging sectors tied to government employment.

RETURN-TO-OFFICE MANDATES

A return-to-office (RTO) by federal workers would boost the beleaguered office segment through increased demand, rent growth, pricing and transaction volume. RTO would also help struggling CBD retail and residential demand.

President Trump recently issued an executive order requiring federal workers to return to office. Though there may be exemptions, the mandate has the potential to impact commercial and residential real estate.

Perhaps more importantly, state and local governments, as well as the private sector, may follow suit and require employees to return to the office, even if under a hybrid-work scenario. Many private employers have tried over the last few years to entice employees back to the workplace with highly amenitized, Class A office buildings. Though tenants are reducing their office footprint relative to pre- COVID-19 levels, hybrid-work arrangements require firms to rent enough space to cater to the office population on its busiest day.

President Trump’s RTO initiative is also designed to cull the number of federal workers, as many employees would rather resign than return to office. Some 46% of workers say that they would be unlikely to stay at their current job if mandated to return, compared to 36% that would remain, the Pew Research Center found. The magnitude of the RTO-mandate effect on the office segment is also in dispute. While the Trump administration has said only 6% of federal employees work full-time in office, the Office of Management and Budget reported to Congress in August 2024 that the figure is 54%. While another 46% were eligible to telework, they spent an average of 61% of working hours in office, and only 10% of federal workers were in fully remote positions.

Should the government’s RTO policies succeed, particularly if the private sector follows suit, office demand and rents could rise, potentially leading to a partial recovery in pricing to the benefit of investors, lenders and landlords. With improving space market fundamentals, lenders may relax underwriting standards and capital could become more available, leading to an uptick in transaction volume, originations and refinancing, and a decline in asset distress.

RTO has the ability to breathe life into central business districts (CBDs) which have suffered the most from work-from-home policies, particularly urban areas. More workers would have a ripple effect on other sectors, bringing greater foot traffic to retail businesses, and accelerating business travel, boosting the hospitality segment. Meanwhile single-family and multifamily housing could see greater demand in these locations. Improving office fundamentals could also drive a partial reversal of the recent office-to-residential (OTR) conversion trend, if office pricing and distressed assets see marked improvement. While OTR conversions still represent a small part of the market, a decline in the new supply of housing would benefit multifamily owners and investors through increased demand for existing space.

On the other hand, a broader RTO movement could cut into demand for residential space as people might need less space for a permanent home office. Just as RTO could breathe more life into CBDs and major markets, this could reduce residential demand and economic activity in non-urban areas or smaller markets.

CONCLUSION

So how will Trump’s policies shake out? Only time will tell, but as explored in this piece, initial market and economic reactions point towards a volatile and uncertain future. CRE lenders and investors will have to show discipline to effectively navigate the foreseeable future and rely on data, strong market insights, and proven partners.

ABOUT SITUSAMC

SitusAMC is the leading independent provider of innovative, trusted solutions to the commercial and residential real estate finance industries. We help clients identify and capture opportunities in their real estate businesses through industry-leading services and innovative technologies that drive operational efficiency, increase business effectiveness, and improve market agility across the entire lifecycle of their global real estate activity. Learn more at SitusAMC.com

DISCLAIMER

This disclaimer applies to this publication and the oral or written comments of any person presenting it. No part of this publication may be reproduced in any form or incorporated into any information retrieval system without the written permission of SitusAMC Holdings Corporation.

This publication is sold with the understanding that the publisher is not engaged in rendering legal or accounting services. The publisher advises that no statement in this publication is to be construed as a recommendation to make any real estate investment or to buy or sell any security or as investment advice. The examples contained in this publication are intended for use as background on the real estate industry as a whole, not as support for any particular real estate investment or security.

Forward-looking statements (including estimates, opinions or expectations about any future event) contained in this publication are based on a variety of estimates and assumptions made by SitusAMC Holdings Corporation. These estimates and assumptions are inherently uncertain and are subject to numerous business, competitive, financial, geopolitical, industry, market and regulatory risks that are outside of SitusAMC Holdings Corporation’s control. There can be no assurance that any such estimates and/ or assumptions will prove accurate, and actual results may differ materially. The inclusion of any forward-looking statements herein should not be regarded as an indication that SitusAMC Holdings Corporation considers such forward-looking statement to be a reliable prediction of future events and no forward-looking statement should be relied upon as such.

This publication does not purport to be complete on any topic addressed. The information included in this publication is provided to you as of the dates indicated, and SitusAMC Holdings Corporation does not intend to update the information after this publication is distributed. Certain information contained in this publication includes calculations and/or figures that have been provided by third parties, and/or prepared internally and have not been audited or verified. This publication may contain the subjective views of certain SitusAMC Data & Analytics personnel and may not necessarily reflect the collective view of SitusAMC or certain SitusAMC business units.

Although this publication uses only sources that it deems reliable and accurate, SitusAMC Holdings Corporation does not warrant the accuracy of the information contained herein and does not have a duty to update it. In all cases for which historical performance is presented, please note that past performance is not a reliable indicator of future results and should not be relied upon as such.

Certain logos, trade names, trademarks and copyrights included in this publication are strictly for identification and informational purposes only. Such logos, trade names, trademarks and copyrights may be owned by companies or persons not affiliated with SitusAMC Holdings Corporation. SitusAMC Holdings Corporation makes no claim that any such company or person has sponsored or endorsed the use of any such logo, trade name, trademark and/or copyright.