SitusAMC Analysis Finds Historic Surge in Apartment Returns, Rent Growth in 3Q 2021

Apartment rent growth and overall returns hit record highs in the third quarter, while cap rates plunged to their lowest level in history, according to a new analysis by SitusAMC Insights, the data, analytics and research division of SitusAMC. “The numbers are truly staggering,” said SitusAMC Insights Senior Director Peter Muoio, PhD. “Though the industrial sector remains the superstar commercial real estate performer, the apartment sector’s growth is extraordinary.”

Newly released data reveal astonishing third-quarter performance nationally and regionally, with a number of big winners across the Sun Belt. “Cap rates for national, institutional-quality properties generally compressed over the last three years, but the COVID-19 pandemic accelerated the trend,” said Jen Rasmussen, PhD, Vice President and Head of Thought Leadership and Publications for SitusAMC Insights.

Returns Soar to New Highs, Cap Rates Plummet to Historic Lows

At the national level, apartment cap rates fell to their lowest level in history in the third quarter to 4.5%, about 170 basis points (bps) lower than their long-term average (LTA). Meanwhile, apartment returns, as measured by NCREIF’s NPI, shot up by 290 bps quarter over quarter (QoQ) to 6.5%, a record high, led by stellar capital appreciation. The sector recouped its pandemic losses within two quarters and its performance has risen steadily since, increasing by over 600 bps YoY. Returns stand 450 bps over LTAs.

National apartment occupancy grew 60 bps over the previous quarter, returning to pre-COVID-19 levels. The gap between asking rent and effective rent also fell throughout the pandemic and is now at the lowest level in three years.

Rent Growth Skyrockets from Previous Quarter

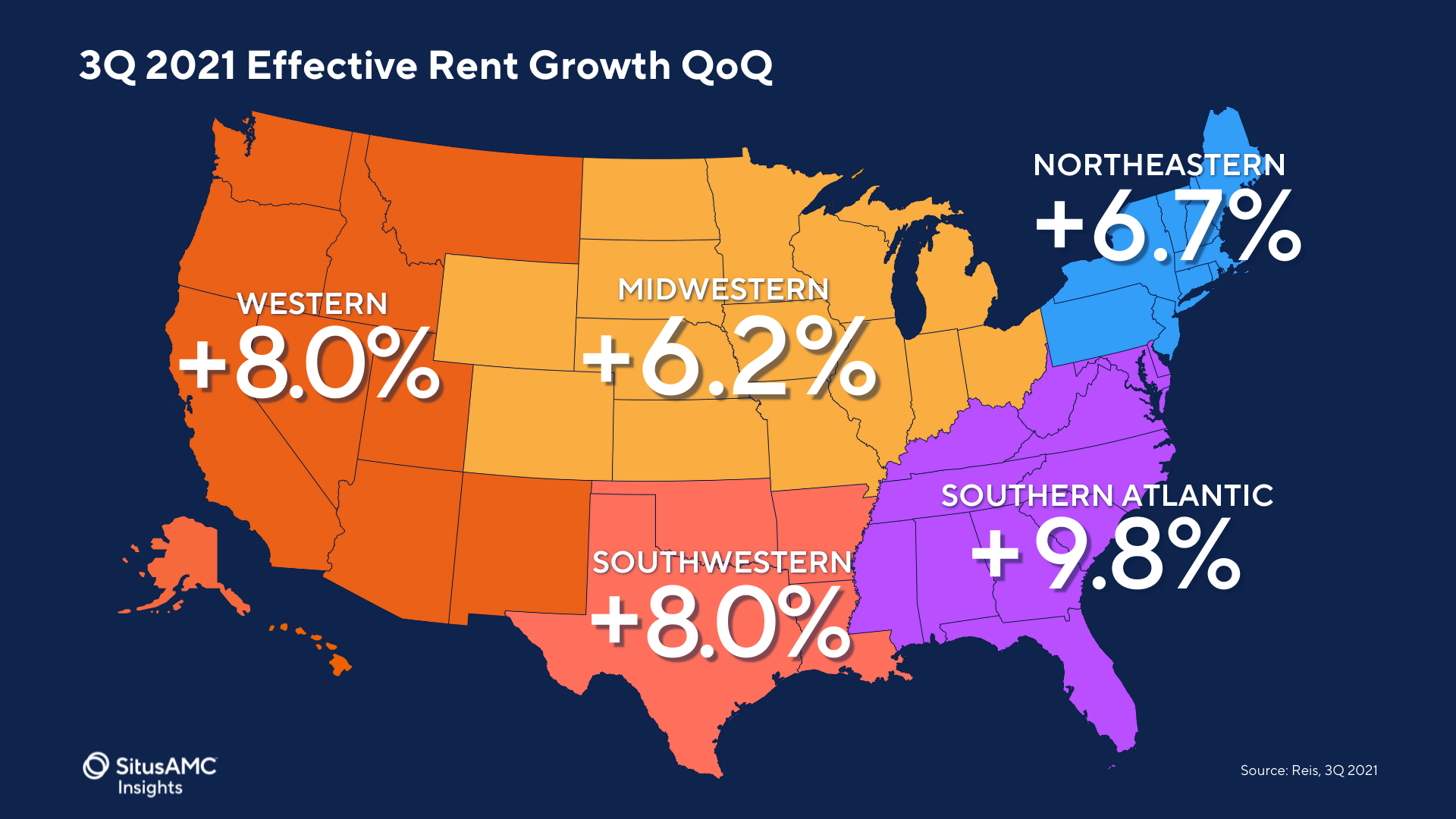

National effective rent growth soared to a record 7.9%, a 670-bps jump over the previous quarter, per data from Reis. “Regional rent growth was also stellar, with all regions of the U.S. recording by far the highest effective rent growth in history, and the South in particular showing sizzling gains,” Rasmussen noted. (See map.)

Garden Apartments Top National Subsector Performance

Garden apartments dominated subtype return performance, hitting a record 8.7% and outperforming LTAs by 640 bps. “The subsector’s rebound from the COVID-19 pandemic has been nothing short of remarkable, with a 740-basis point increase year over year, and a 330-basis point surge over the previous quarter,” Muoio said.

Low-rise apartments outperformed high-rise buildings, but both sub-types enjoyed an exceptional third quarter. Though not quite record-breaking, low-rise returns hovered near 6.4% and high-rise apartments returned about 5.5%, more than 400 bps and 350 bps above LTAs, respectively.

Regional Records in the South and West

The SitusAMC Insights regional analysis found record high total returns in both the South and West. The South recorded an 8.0% return, according to NCREIF data, the highest in history, and nearly 600 bps above the LTA. In the West, returns soared to a record 6.8%, about 450 bps above the LTA. While not quite a record, returns in the East came close at 5.6%, and the Midwest posted the highest returns in a decade.

Meanwhile, cap rates plummeted to record lows in the Midwest and South in the third quarter, each tightening by 20 bps QoQ. "Since the beginning of the year, cap rate compression has been most pronounced in the South followed closely by the East at 50 bps and 40 bps, respectively," Rasmussen noted. The West and Midwest regions priced up by 10 bps each. Click through the slideshow below for more detail on third-quarter apartment performance in each region of the U.S.

Garden Apartments Lead Regional Sub-Type Returns

On a regional basis, garden apartments outperformed other sub-types on a regional basis in the third quarter, with the South’s record-breaking return of 9.5% coming in more than 700 bps higher than the LTA. Garden apartments in the East and West were not far behind, hitting historical highs at just over 9% and 8%, respectively. Meanwhile, high-rise apartments in the South scored their best performance in over two decades, and low-rise the best in 11 years. Across all regions, high-rise apartment returns doubled over the last quarter. In the East, low-rise apartment returns more than doubled over the previous quarter to a record 8.1%. Garden apartments also showed dramatic rent change QoQ.

Sun Belt Stunners Dominate Metro Returns

The SitusAMC Insights analysis also examined specific metro returns, uncovering impressive third-quarter performance across a number of Sun Belt markets. The top eight performers include: Phoenix, Tampa Bay, Raleigh, Memphis, Riverside, Nashville, Las Vegas and Charlotte, based on an amalgamation of RERC cap rate data, NPI returns and space-market fundamentals. Except for Phoenix, all markets fell outside the 20 largest markets based on inventory.

“These mid-size markets concentrated in the Sun Belt experienced an acceleration of the robust, years-long growth trend in the region,” said Muoio. Some of the top-performing metros registered the highest quarterly returns in history and many more had the largest rent increases in the past two decades, according to Reis. (See chart.)

Phoenix, for example, has been drawing new residents for nearly two decades, ranking in the 10 fastest-growing U.S. cities in both the 2010 and 2020 Censuses. Apartment returns in the third quarter came in at the second-highest level since 2000. The effective rent change of 16.1% in the third quarter was more than four times the next-highest quarterly increase over the past two decades.

Meanwhile, California’s Inland Empire, where Riverside is located, tied with Phoenix for the largest gains in household migration nationwide in 2020, drawing residents from Los Angeles and other cities during the pandemic. Riverside-San Bernardino recorded the highest apartment returns in one quarter in the metro’s history – about 150 basis points higher than the previous record. Apartment appreciation returns ranked as the seventh highest among major markets in NPI-NCREIF returns. Third-quarter rent growth – up 12.1% from the previous quarter – was among the highest in the country.

Significant cap rate compression occurred in Phoenix, Tampa and Charlotte, each recording a more than 100-bps drop in cap rates over the quarter. Las Vegas, Nashville and Memphis recorded their lowest cap rates in history. For all major cities tracked by NCREIF, a rising tide lifted (almost) all boats, with returns accelerating for all but two markets: Baltimore and Orlando had better second-quarter returns than in the third quarter. New York, Chicago and San Francisco all had returns around 3%, the highest these three underperforming markets have recorded since the mid-2010s. Returns in many markets were more than 150 bps above previous highs; Raleigh and Nashville were 400 bps higher.

Of the top eight markets, all except Nashville and Charlotte recorded effective rent increases of more than 800 bps from previous quarterly highs. (See chart.) Even the markets with the slowest rent growth in the quarter showed remarkable quarterly gains. At the “bottom” of the heap, Chicago, New York and San Francisco recorded between 6% and 9% rent growth over the quarter.

To learn more about SitusAMC’s research and data offerings, click here.

To learn more about SitusAMC’s research and data offerings, click here.