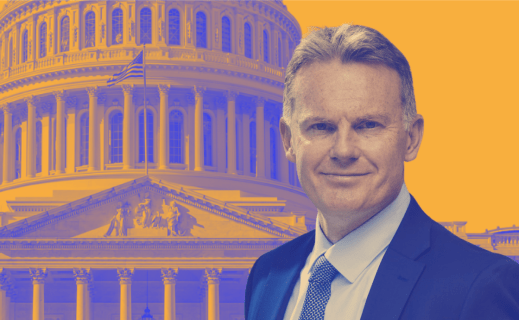

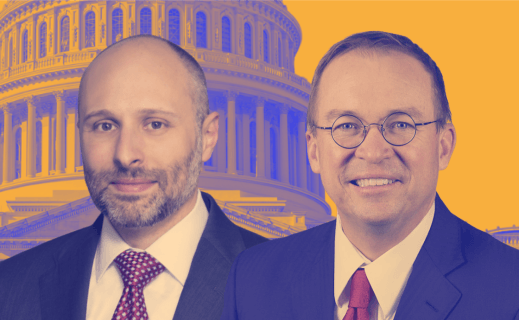

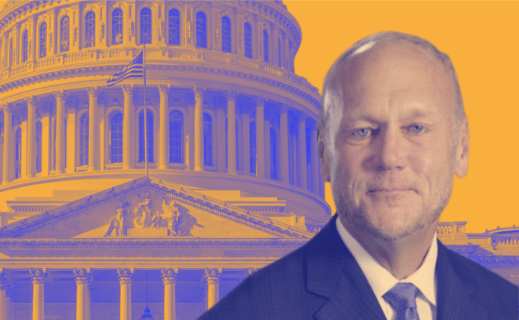

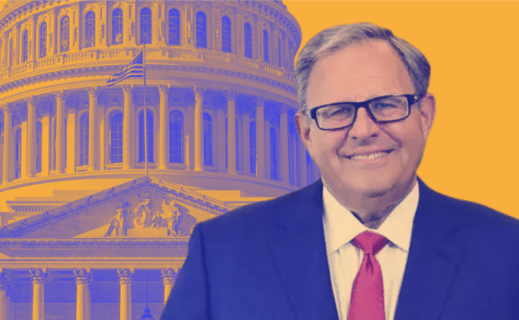

On the Hill Episode 23: Ed Delgado of Mortgage Policy Advisors and Blake Hastings of SWBC

In this episode of "On the Hill," Tim Rood talks with Ed Delgado, managing director of Mortgage Policy Advisors, and Chairman Emeritus of Five Star Global, parent company of the Five Star Institute, the industry trade group; and Blake Hastings, SVP of corporate strategy and chief economist for SWBC, a financial services firm based in San Antonio, TX. The two recently authored a research report, Mastering the Mortgage Maze in 2023: Market Outlook and Risk Management for Lenders, which explores opportunities and challenges for the housing and mortgage markets from an economic perspective. They discuss the prospects for a recession, the effect of rising interest rates, demand and supply trends, increasing regulatory activity and more.

Strong employment continues to buttress the housing market, although labor demand is beginning to cool, helping temper inflation, Hastings said. "Employers are having a rough time finding and keeping workers," he said. "Even though I believe we are headed for recession, it will be mild. Employers are going to be loath to let people go." Recession will be felt unevenly across the U.S., Hastings added. States that have experienced strong net in-migration, such as Florida, Texas, Nevada, Idaho, Arizona, the Carolinas and Tennessee, could avoid recession altogether, while California and other states that have lost workers could face a more dramatic downturn.

The prospect of recession calls for better risk management, Delgado cautioned. With few material defaults and foreclosures at or near record lows, servicers may have been lulled into a state of complacency. "Conditions right now are favorable, companies are managing through this period, and everybody came out relatively unscathed from the pandemic," he said. "So investing in technology and human capital, and making sure that you're prepared seems to have taken a bit of a back seat for many."

Rising interest rates, which have sent both buyers and sellers into retreat, also create challenges for servicers in the event of default. The benchmark federal funds rate hit its highest level in more than two decades on July 26 after the Federal Reserve raised it to a range of 5.25% and 5.5%. "If a homeowner is sitting on a 3% mortgage and runs into any trouble, you can't modify 3% mortgage," Delgado said. "So there's some built-in risk right now in the mortgage market."

With executive positions at Wells Fargo and Freddie Mac, Delgado has hosted discussions over the years with various global leaders, including two U.S. presidents. He discusses some highlights. Rood and his guests also cover renewed regulatory pressure on lenders, and how the government's procyclical role in the housing market could exacerbate an economic downturn.

Listen to the podcast above.