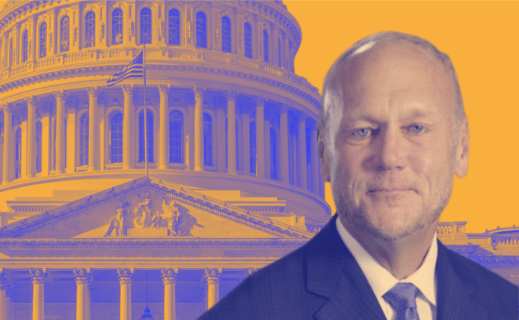

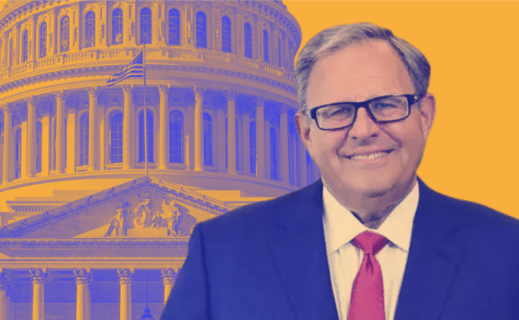

On the Hill Episode 25: Mick Mulvaney, Former Acting WH Chief of Staff, and Eric Blankenstein, Former EVP and COO at Ginnie Mae

In this episode of "On the Hill," Tim Rood talks with Mick Mulvaney, Former Acting White House Chief of Staff and Co-Chair of Actum LLC, a consulting firm; and Eric Blankenstein, an attorney and former Executive Vice President and Chief Operating Officer at Ginnie Mae. They discuss how federal dominance of the mortgage market has stifled innovation, legislated the risks private lenders can take and changed American attitudes toward mortgage obligations.

"I think it's inevitable that the government intervention into the [real estate] market will continue unabated," said Mulvaney, the former Office of Management and Budget director, South Carolina Congressman and special envoy to Northern Ireland. "The only question is going to be whether it's rapid under Democratic control, or a little bit more measured under Republican control. But the overwhelming majority of those elected to Congress now believe in government intervention, in one way or another."

Blankenstein, who previously held roles at the Consumer Finance Protection Bureau and the Department of Housing and Urban Development, agreed. "The federal government is there monitoring your servicing, default servicing, servicing transfers, foreclosures," Blankenstein said. "At every at every step of the way, there is serious government intervention. So it is kind of hard for me to think about a real estate [and] mortgage industry that's not also thinking about federal government programs."

Government intervention during the Global Financial Crisis (GFC) and Covid-19 has warped consumer behavior, Mulvaney said. "There are decades of data on what Americans prioritize in terms of what they pay, especially when things get tight," he said. "It used to be that the very first thing that everybody paid was the mortgage or the rent, because if you didn't, you didn't have a place to live. What's the first thing they pay now? The cell phone, the car -- and the mortgage is way down on the list. Because they know it's really hard to get kicked out of your house. Not impossible yet, but really, really hard."

Mulvaney also discussed his involvement in addressing the imminent collapse of Fannie Mae and Freddie during the GFC in 2008. "Their balance sheets were shit," Mulvaney said. "I was in the camp that wanted them to rebuild their balance sheets. I didn't think they would ever be privatized, because no one's ever going to want to buy something that looks like this."

Rood and his guests also discuss:

-

how state and local governments constrict housing supply through land use, permitting and zoning restrictions, and what the federal government could do to incentivize more construction;

-

why the Federal Reserve has abandoned the traditional long-term inflation target of 2%;

-

how student loan forgiveness could jeopardize funding for the Affordable Care Act;

-

and why Congress can't balance the federal budget.

"The most common line I remember encountering on all my budget interactions with Congress was 'we can't afford not to do it,'" Mulvaney said. "The words that don't exist on Capitol Hill are offsets or how pay for it. They don't ever, ever, ever do that. Like right now that administration sent down a $106 billion request, mostly for Ukraine. And no one's even trying to have a conversation about how to pay for that. They're going to print the money, which is going to be stimulative and inflationary."

Listen to the podcast above.